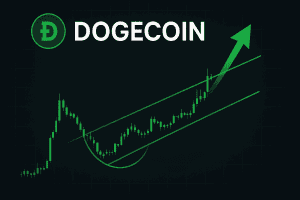

Dogecoin (DOGE) is once again on the radar of market technicians — sitting at a decisive point where history, sentiment, and structure intersect. While near-term price action shows stress, long-term charts are quietly building a case for something much larger.

The Long-Term Setup: Accumulation Meets Structure

On multi-year timeframes, two dominant formations define DOGE’s current structure:

The Accumulation Base:

A pronounced rounded-bottom or cup-and-handle structure has been forming over time. This pattern typically marks the exhaustion of sellers and the quiet re-entry of long-term buyers — conditions that have historically preceded major price expansions.

The Ascending Channel:

DOGE continues to trade within a wide, rising channel. The current price region sits near the lower boundary, often considered a “launchpad zone” for previous rallies. For patient traders, this area offers a strong risk-to-reward narrative if trend support holds.

Momentum Snapshot: Calm Before the Push

Momentum metrics are telling a similar story. The Relative Strength Index (RSI) remains in a low, steady range — similar to levels that have preceded explosive upswings in past cycles. This suggests untapped upside potential if market sentiment improves.

Current Range: $0.17 – $0.19, with mild volatility.

Critical Support: $0.18 — a breakdown could revisit $0.07.

Breakout Zone: A sustained close above $0.20 – $0.21 could confirm the next bullish leg.

Upside Projections: Moderate targets cluster between $0.50 and $1.00, while speculative cycle highs extend to $4.00 +.

Trader’s Perspective

For retail traders, the message is balance and discipline. The long-term chart favors a bullish continuation, but confirmation is crucial. Use the channel’s lower boundary as your stop-loss reference and let the $0.20 – $0.21 zone dictate your breakout bias.

Key Takeaway

Dogecoin’s multi-year structure points toward a potentially rewarding setup — but timing and risk control are everything. Watch for breakout confirmation above $0.21 before scaling in, maintain stops below structural support, and approach each rally with patience rather than impulse.Clarity over hype — that’s how retail traders stay ahead.