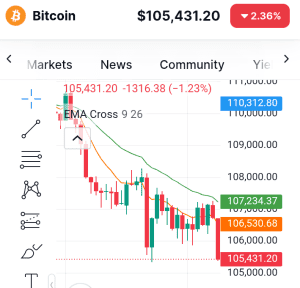

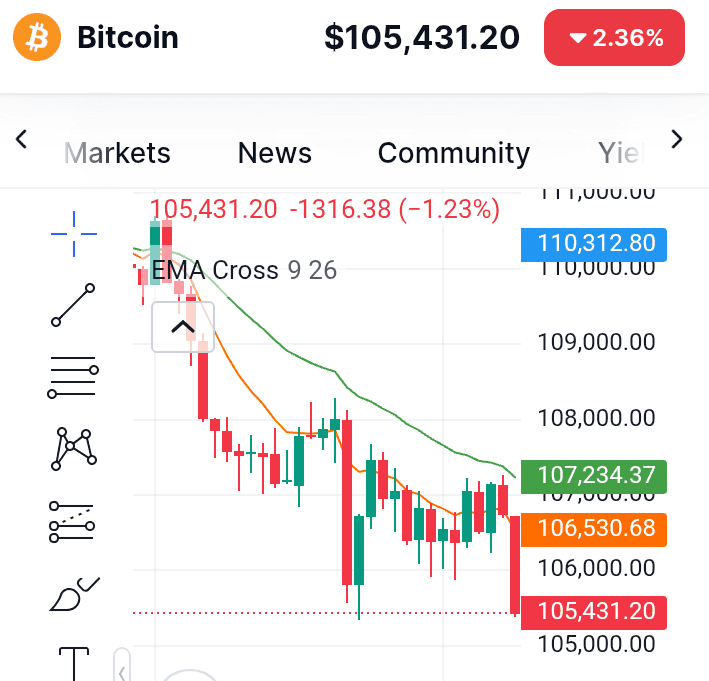

Bitcoin holds the line at $106K–$110K as markets weigh macro relief against technical hesitation.

Bitcoin is hovering between $106,500 and $108,900, pausing after last week’s retreat from the $110K zone.

Ethereum trades near $3,792 (-2.27%), while Solana and BNB ease to $183.74 (-1.10%) and $1,057 (-3%). Dogecoin also softens, slipping 3.1% to $0.18.

Market Sentiment

Market sentiment remains defensive: the Crypto Fear & Greed Index sits at 33, a slight improvement from 29 but still deep in “fear” territory.

Traders remain alert, watching for a catalyst strong enough to break Bitcoin’s tightening range.

Institutional Flows: Conviction Over Caution

ETF activity opened November on mixed footing, with $191.6 million in outflows.

Still, the big picture shows commitment—October recorded $3.69 billion in net inflows, led by BlackRock and Fidelity.

Why It Matters

Institutional hands appear steady. Nearly 7 million BTC have moved back into profit over the past ten days, including 5.1 million coins held by newer investors (Coinpedia). That pattern typically marks the early phase of a new accumulation cycle—where conviction builds quietly before momentum returns.

Macro Shift: The Fed Blinks, Markets Pause

The Federal Reserve’s 25 bps rate cut and decision to end quantitative tightening (QT) (Ainvest) should, in theory, breathe life into risk assets. Yet Bitcoin dipped below $108K after the announcement, a sign that sentiment hasn’t fully priced in the dovish shift.

Geopolitical and trade tensions continue to blur the outlook. The macro backdrop favors risk exposure—but as the market reminds us, policy easing means little without technical follow-through.

Seasonality Check: November’s Track Record vs. 2025 Reality

Historically, November is one of Bitcoin’s strongest months, averaging an 11.2% median return (BeInCrypto). The long-term median peak points to potential upside toward $125K, yet this cycle’s hesitant start suggests traders are waiting for confirmation before re-risking.

The Takeaway

Seasonality supports the bulls—but discipline, not nostalgia, should guide November positioning.

Technical Pulse: Tight Range, Big Setup

Support: $109,208 → $107,696 → $104,582

Resistance: $110,433 → $115,600200-day EMA: ~$108,350 — the critical pivot

RSI: 46.3 (neutral)Fear & Greed: 33 (weak appetite)

Bollinger Bands are compressing, hinting at an imminent breakout. A daily close above $110K would confirm fresh bullish energy; failure to defend $107K–$104K could invite a flush toward the $100K psychological zone.

What to Watch

Macro: Follow Fed commentary and U.S.–China trade signals—negative headlines could test $105K.Flows: ETF inflows above $200 million per day = renewed institutional confidence.Price: Hold above $110,433 to unlock $115K+ targets. Lose $107K and the next stop is $100K.November’s historical tailwind is real—but the breakout belongs to traders who wait for confirmation, not hope.